Valuation Best Practices for Business Valuation Firms

The process of undertaking a business valuation should be well understood and free from ambiguity however we find that with many business valuation firms this is not the case.

In a current matter that we are involved in the business valuation firm for the seller of shares in a company treated more than $1 million of shareholder loans by the Company as equivalent to a trade receivable. This caused the value of the goodwill to be misstated. The valuation report also did not include a balance sheet for the entity as at the valuation date. The business valuation firm in question had many years of experience and in our opinion is typical of what we find across a broad range of valuation reports.

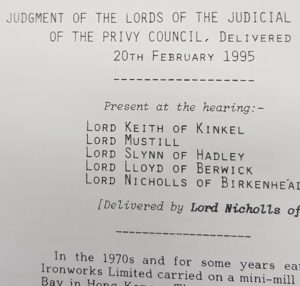

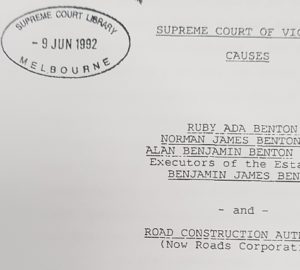

At Rushmore Group we are often engaged to either critique or review business valuation reports prepared by others. Where possible we provide our opinion and also any judicial support in relation to the issue in question. The use of case law to support a conclusion can also assist in breaking a deadlock between the parties in a dispute.

Business Valuation Formula

In the above example with the $1 million in shareholder loans ultimately this was an issue with the basic business valuation formula that was used by the business valuer rather than a difference of opinion as to a variable within the formula. Different business valuation experts are entitled to have different opinions as to the appropriate inputs into a business valuation report however ideally the formula and basic methodology should not be in dispute.

We are also still seeing business valuation reports with broad statements. For example, the business valuer will say that in their opinion “a multiple between 3 and 5 is appropriate” and they have then selected the midpoint of 4 times. From the view of preparing an expert report for legal proceedings and indeed any other purpose, we believe that this approach is too broad. It also fails to critically analyse comparable businesses that have been recently sold.

The Business valuer has a number of options available to them in identifying comparable capitalisation multiples. This includes:

- Public announcements as to a purchase and sale of a business

- Independent surveys

- Business for sale advertisements with appropriate adjustments (although this is not as persuasive as transactions that have been completed by a willing buyer and willing seller).

An essential part of the business appraisal service (when applying a capitalisation of future maintainable earnings or discount cash flow technique) is to research and identify comparable transactions. Identifying suitable evidence for an opinion brings a rigor and professionalism to a business valuation report.

Business Appraisal Services

In another matter we are involved with the business valuer in reaching their opinion as to the value of the Business made adjustments that he believed were reasonable. However these adjustments were invalid from a legal point of view. These adjustments made by the valuer changed the business valuation formula and led the business valuer to an erroneous conclusion.

It is therefore important that the valuer has an appreciation for the legal environment that they are operating in.

We typically undertake engagements in relation to the purchase /sale of business, family law valuations, compulsory acquisitions of lessee interests and valuations for tax purposes.

At Rushmore Group we specialise in only engagements that include business valuation services. For example undertaking valuations, critiquing valuation reports prepared by others, related forensic accounting engagements and compensation matters with valuation issues. This approach means that we can develop deep expertise in these subject areas.

For a confidential discussion, please contact Rushmore Group today on 1800 454 622.

Andrew Firth (Author)

View Post